Perfect Money Review: Sign Up, Deposit, Withdrawal, Fee, Verification, Security

In this review, we will look at the most important topics regarding Perfect Money: Sign-up procedure, fees, verification, deposit, and withdrawal options. We believe this will be one of the most detailed and accurate Perfect Money e-wallet reviews to be found on the internet. Find out what Perfect Money is and how to use it. There is a lot of information, so get comfortable in your chair, and let's start studying the Perfect Money payment system from A to Z.

What is Perfect Money?

Perfect Money is an electronic payment system that offers a range of features for secure and convenient online transactions. Anonymous money transfers over the Internet are made simple with Perfect Money, it is a reliable alternative for traditional online payments like bank transfers. Making a transfer no longer requires a trip to the bank or a lengthy wait at an automated teller machine. Perfect Money offers tremendous opportunities to internet users and business owners.

Perfect Money users may convert their funds into digital currencies in minutes and at a reduced rate. They have a long-standing financial arrangement that permits them to send and receive wire transfers from all over the world. Read the whole article to learn all you should know about the Perfect Money e-wallet.

Perfect Money users may convert their funds into digital currencies in minutes and at a reduced rate. They have a long-standing financial arrangement that permits them to send and receive wire transfers from all over the world. Read the whole article to learn all you should know about the Perfect Money e-wallet.

History of Perfect Money

Perfect Money, initially launched in 2007, is one of the world's most popular cashless payment networks. The company promotes itself as an excellent alternative for managing your assets quickly and securely. Its main advantage is that users' personal information is kept entirely confidential. Perfect Money Finance Corp is headquartered in Zurich, Switzerland, with offices in Hong Kong. Customers may now use Perfect Money to execute private transfers, including monthly payments, pay for goods and services via the Internet, keep cash and crypto-currencies with a profit on the balance, and much more. Perfect Money is also a frequently used e-currency on the XMLGold e-currency and cryptocurrency exchange. More and more online stores are starting to accept Perfect Money payments. Many online business projects have found this payment system to be useful. This payment method can be beneficial to you if you are interested in anonymous and instant payments. Despite its popularity, Perfect Money is a quite specific payment system. Consequently, we'll go through the payment system's features and tools in more detail.

Perfect Money Account Types

When you register on Perfect Money, you have the option of selecting one of the following account types:

Normal:

A new client who signs up on one of Perfect Money's website is offered a standard account. It has some cons, but overall it places no limitations whatsoever.

Premium:

Users who have kept their accounts active for at least a year are eligible for premium accounts. You must contact customer service if you wish to upgrade your account from ordinary to premium. An additional perk of a premium account is a discount of 2% on all Perfect Money transactions.

Partner:

Partner accounts are issued based on strong financial management. This account is for people who wish to improve the functionality of their websites for commercial transactions. These accounts are exclusively accessible to company owners who run their activities online. Having a partner account is an honor since it shows that you are reliable and trustworthy.

Perfect Money Sign-Up Process

To use the Perfect Money e-wallet, you must first understand it. Perfect Money is a kind of electronic wallet, in some points, similar to PayPal, Skrill, Advcash, Payeer, and some other online payment systems. It enables users to send money and make and receive payments via the Internet securely and near-instantaneously.

Follow these steps to establish a Perfect Money account (e-wallet):

Step#1:

To start the process, you need to visit https://perfectmoney.com/

Go to the website and click "Signup" to register a Perfect Money account.

Step#2:

Fill up the fields with your details. You must first provide personal information to open a Perfect Money account.

The following is a synopsis of the data:

- Your full name.

- The city's name.

- The name of your nation.

- The postal code.

- Your email address

- Telephone and fax (Optional).

After that, the following information is provided:

- Account type: For most users, choose "Personal."

- The password for your Perfect Money account.

At the bottom of the section, you will need to enter the following information:

- Enter the turning numbers after this.

- Accept the terms and conditions in their entirety.

- Click “Register” to set up an account.

Step#3:

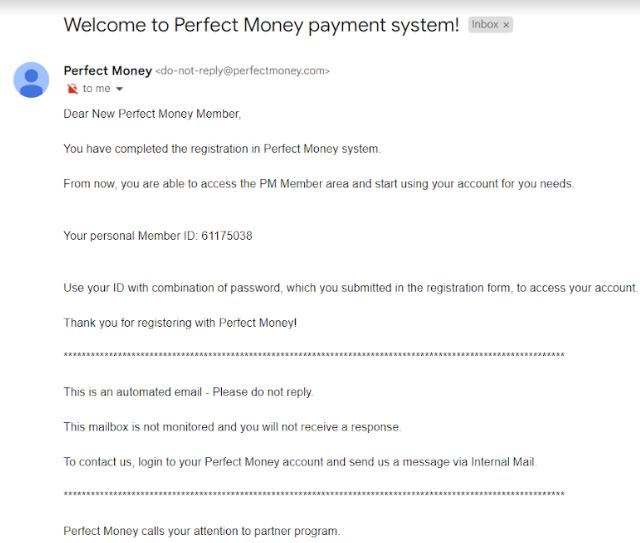

Go to your email to get your member ID. After completing the Perfect Money registration procedure, you'll get an email requesting you to check your inbox for a member ID.

Step#4:

Look through your inbox for a message with the subject "member ID" and open it.

Step#5:

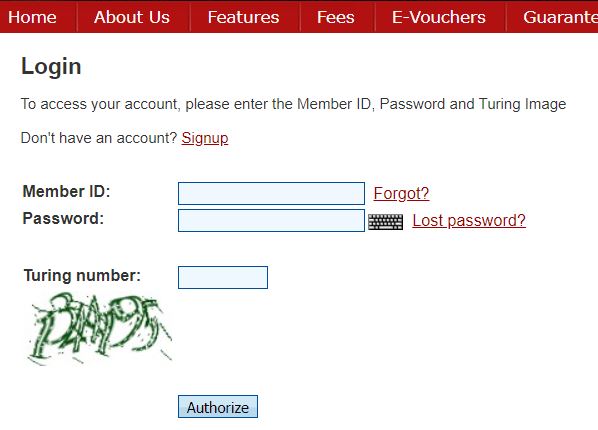

Log in to Perfect Money using the ID you just received. Return to the Perfect Money interface and log in to your account by selecting the "Login" button.

The steps are as follows:

- Enter the membership ID you just received.

- Turing's number

- Finally, click "Authorize" to finish the login procedure.

The interface for your account appears when you log in. At this time, you have successfully established your Perfect Money account.

Perfect Money Login Process

The login process is fast, simple, and secure.

To Login in to the Perfect Money website, go through the following steps:

- Step 1: Go to the "Login" tab.

- Step 2: Enter the client ID and password.

- Step 3: Double-check the submitted information.

After successfully logging in, the user navigates to the client area page. A toolbar at the top of the page enables you to go to the desired area of your account. The My Account feature welcomes users when they enter the client area. You may view the configured security settings and account reference information, such as transaction records, and all active accounts.

Perfect Money Fees

Perfect Money service fees have been minimized to ensure it is the most cost-efficient and convenient online payment solution. Perfect Money charges different costs for transferring money to, from, and within the account.

You may see the exchange rate for Euros, Bitcoins, Gold, or US Dollars on your account at any time. Commissions may change over time, so check fees with your broker one more time, but deposits are often free. Withdrawal fees are 0.5% for verified businesses.

Perfect Money “Fees” section: https://perfectmoney.com/fees.html

Perfect Money Security System

To safeguard your account, go to the "Security Centre" page. Here you may look at the IP address from which the user connects. You will get an email with a verification code each time you log in, and it is a procedure that should not be altered.

Perfect Money offers multi-level security for personal information:

1. Person Identity Check:

This tool is used to locate clients who have PM accounts. This gadget is a kind of Perfect Money artificial eye that cannot display the customer's face in real time but can identify the computer used to establish the account. Suppose a Customer registration attempt is attempted from an IP address network or subnet that is not associated with the account holder. In that case, the account is blocked, and an extra security code is issued to the email address provided at account registration. The Perfect Money Support Center handles individual IP changes.

Suppose a Customer registration attempt is attempted from an IP address network or subnet that is not associated with the account holder. In that case, the account is blocked, and an extra security code is issued to the email address provided at account registration. The Perfect Money Support Center handles individual IP changes.

2. SMS Authentication:

This method creates a logical relationship between a user's account and mobile phone number. The system sends a confirmation code allowing the authentic account holder to be recognized. Because the time spent on the complete operation of code transmission and account entry is very short and insufficient for cracking, the SMS Login system is one of the most perfect and dependable types of Customer protection against unauthorized account access.

3. Code Card Protection:

The customer gets a card with a visual depiction of the code emailed to them. The system may ask the user to send a specific code from the card to verify a transaction in response to a random order. Most of the world's largest financial institutions employ code cards as a simple and efficient security method for transaction verification.

4. Anti-Fraud Screening System:

Perfect Money's anti-fraud scanning technology is a cutting-edge security solution that benefits its customers. Each login and every transaction is subjected to an anti-fraud screening procedure, which prevents money theft. This system includes patented activity-tracking algorithms that make Perfect Money a safer environment for consumers while making it unpleasant for those who attempt to use it illegally. After choosing this option, a file with the extension ".png" will be loaded, where you will find the codes that must be entered when making any financial transaction. The identical file will be sent to your email address. Enabling profile protection is an important step that helps the client to defend himself from intruders who try to hack into his account. It is an essential thing that should not be overlooked. You may use Perfect Money services immediately after registering and setting security measures. To reduce the commission %, we need to complete the verification process. To do so, go to the settings section and go through each step individually.

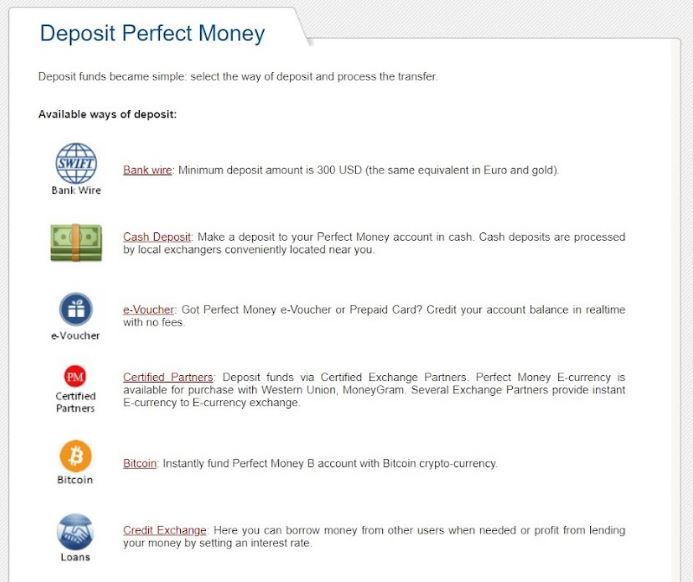

Perfect Money Deposit Options

The users of the Perfect Money system may replenish their balance in many different ways:

1. Internal Transfer:

E-money sending via internal transfers is a definitely convenient way to exchange funds. To receive an internal transfer, you must supply the sender with your account number, email address, or mobile phone number. The system charges a fee to manage internal transactions; thus, the amount deposited differs from the amount communicated. The Perfect Money e-voucher can be a convenient way to exchange funds between PM users as well. You may discover more about the costs in the "Fees" section.

2. Bank Wire:

Bank wire transactions are only available to verified account holders. It is straightforward to make a bank wire deposit, fill out a bank wire order form, and choose a bank account for the transaction. Accurately entered information is rewarded with the ability to monitor the progress of your bank wire, so don't be superficial about giving the correct details. After completing the bank wire refill form, click the "Preview" button. Examine all the information, choose the primary and secondary authorized exchange services from the list of partners provided, and then click "Send." The primary approved transfer service provider will accept your order for review 24 hours after you put it. Suppose the primary exchange service provider cannot execute your petition. In that case, the application is transferred to an alternate approved exchange service provider. The maximum order processing time for each exchange service is 24 hours. If your request is approved, you will get an email and an internal system mailbox message with the bank account details to which you must pay your payments. Such bank account information is also available in your purchase's "Deposit" part. Funds from a bank wire may not appear in your Perfect Money account for up to 5 business days after they have been sent. A bank wire deposit of at least $300 is required.

3. Certified Currency Exchange Partners:

Use one of Perfect Money's approved exchange service partners to deposit funds into your Perfect Money account. All of the services stated on the certified exchange service partners' websites have been thoroughly vetted and tested, guaranteeing that transactions go smoothly. The highest Perfect Money Trust score at the time of writing belongs to XMLGold e-currency exchange. Below is a video tutorial on how to exchange USDT to Perfect Money:

Each exchange partner's terms and conditions, as well as deposit choices, can be unique. We strongly advise you to go over all of the content. Among the exchange service partners, many of them provide a diverse variety of Perfect Money purchasing options. You may fund your PM account with a credit card, bank transfers, cash, e-currency, cryptocurrency, or a combination of these.

4. Bitcoin:

Bitcoin is a well-known cryptocurrency worldwide. To deposit Bitcoin into an account, a user must first create a deposition order containing the account number and the amount to be charged in Bitcoin, then inspect and confirm the order. After completing your purchase, the system will email you a Bitcoin address to which you must deposit the required amount within 24 hours. Your deposit will be completed once the Bitcoin is received, and each payment requires at least three confirmations. The amount sent to a Bitcoin address should equal the invoice value. If you choose to pay in two or more installments, be sure that the total amount matches the deposit amount specified on the purchase form. If the quantity of Bitcoin transferred differs from the amount specified in the order form, the process may take longer. Contact customer support if the funds have not been transferred into your account within 24 hours. The PM service charge for Bitcoin deposits is 0%.

5. Credit Exchange:

You may fund your Perfect Money account by borrowing money from other PM members. To utilize the Credit Exchange, log into your Perfect Money account and click on the appropriate area. You must complete an application or investigate existing loan offers that may interest you if you need a loan. If a lender's proposal meets a borrower's requirements, the funds are sent to the borrower's account after completing the transaction. Such transactions may be carried out automatically or with the borrower's permission. Loan applications contain the loan amount, repayment period, and interest rate. The Credit Exchange does not impose any additional fees. Lenders pay a standard 0.5 percent on demand to transfer money to a debtor. Borrowers must also pay a typical 0.5 percent fee when transferring cash to a lender.

Perfect Money Withdrawal Options

It is straightforward to convert Perfect Money's electronic currency to real fiat money or other payment options.

Withdrawals are possible in the following ways:

1. Internal Transfer:

If you want to transfer money internally, choose the account from which you wish to send funds, then enter the account number and amount to send. The approach computes and displays a service fee as well as the amount received by the end user. You may choose to make a one-time payment or set up a subscription plan. The technology also allows transfers to mobile phones and email addresses, and fees vary based on the kind of account.

2. Bank Wire:

The procedure for withdrawing funds by bank transfer is simple. To make a bank wire withdrawal, go to the "Withdrawal" section, choose "Withdrawal Through Bank Wire," and fill out all necessary documents. Your account details may be obtained from your bank. Using the "Preview" option, ensure that all the information is accurate. You may also choose your leading authorized exchange service provider and secondary authorized exchange service provider from this page to finish your application. After double-checking your information, click "Confirm withdrawal," and your bank wire withdrawal request will be recorded in the system. A Registered Exchange Service partner will process your request within 24 hours. As soon as the withdrawal process is completed, the bank wire invoice number will be supplied. The withdrawal limit amount is established for each authorized exchange service partner. This withdrawal option is only available to verified users.

3. Certified Currency Exchange Partners:

Use a partner of Perfect Money's Authorized Currency Exchange program to withdraw funds from your Perfect Money account. All of the services available on the websites of the exchange services partners have been thoroughly inspected and tested, guaranteeing that transactions go smoothly. Each exchange partner's terms and conditions, as well as deposit choices, can differ.

4. Bitcoin:

Bitcoin is a well-known cryptocurrency worldwide. To withdraw funds from a Bitcoin account, a user must create a deposit order indicating the report used, the applicable Bitcoin address, and the amount to remove. After you've double-checked everything, click "Confirm."

5. Credit Exchange:

Because the borrowed money will be returned to the exact location, offering a loan is not a technique for taking cash from your account. However, putting it to work for you is a simple way to make money.

Where To Use Perfect Money Payment System?

Perfect Money is a worldwide payment system that specializes in online transactions. Some things you can do with Perfect Money are listed below:

- Raise funds for various business initiatives over the Internet; make regular payments via the Internet; deposit funds in a secure electronic account; and earn interest.

- Purchase goods and services from many online shops and marketplaces (for example Buysellvouchers.com).

- Safely store your belongings in Bitcoin without needing a separate wallet.

- Buy Bitcoin, gold, US dollars, and Euros online; borrow and lend Money on your terms.

What Can You Buy With Perfect Money?

With a Perfect Money account, sending and receiving electronic payments is simple. It allows for online payments from one digital currency system to another. You may configure your Perfect Money account through the user account profile to make automatic payments to numerous linked Internet firms. The minimum deposit is $1000, and the monthly interest rate is up to 4%. Currency exchanges, bank transfers, alternative payment methods, and e-vouchers are all frequent means of Transferring Money to and from accounts. The ability for customers to obtain gold, Euros, and Dollars in real-time is one feature that sets Perfect Money apart from the many competitors. Perfect Money customers may pay their bills and transfer money promptly online. The technology is safe to use and does not need any special knowledge. PM is a global payment service that everyone on the planet may utilize.

Perfect Money vs Payeer

Payeer is a multi-currency payment system that allows you to send and receive fiat money and cryptocurrencies. There are advantages and disadvantages to using Payeer. Still, the main feature is that you may receive cryptocurrencies and withdraw in fiat money. Perfect Money, as a payment gateway for sending and receiving money, enables you to fill your account with Bitcoin and earn interest on it. You may withdraw Perfect Money in many ways, including Western Union.

Conclusion

Is Perfect Money the easiest method to deposit and receive funds anonymously from a foreign exchange account? In some specific cases, there are some more alternatives that can match this purpose. However in many situations, though, traders may find Perfect Money a more convenient alternative than other e-wallets and payment methods. Before opting to utilize Perfect Money, it's a good idea to do some basic research. Examine the About page, FAQ, and costs, and learn about the site's history. You might also find out whether any other vendors you know utilize it. Find out whether they had a good experience and thought it was quick, easy, safe, and reliable. Another option is to contact Perfect Money's customer service team, which is available 24 hours a day, seven days a week. Ask your questions and see what you get in response. It's a terrific way to assess whether the site caters to your demands. To summarize, always make financial decisions based on your knowledge and common sense. Many customers seem to be pleased with Perfect Money. However, many others may wish to collect additional information about the operation and specifics of this service.

Pros of Perfect Money:

1. Transaction Anonymity:

When transferring Perfect Money, the eventual recipient only has access to the account number and the user's login.

2. Instant Transactions:

Payments are processed inside the system in a couple of seconds.

3. Convenient and Straightforward Interface:

The site is not overloaded and is simple to use, even for beginners.

4. A Large Number of Partner Points:

Each user may choose the best deposit or withdrawal method for themselves. Customers may utilize borrowed money to conduct their enterprises or use this option to supplement their income by acting as a lender.

5. The Availability of a Mobile Application:

In many cases, a mobile application can be a quick and convenient solution to make payments promptly.

6. The Availability of an Affiliate Program:

You have the opportunity to earn passive income with the Perfect Money referral program.

Cons of Perfect Money:

1. Money transferred improperly cannot be returned and applies to any unauthorized activity on your account. In these cases, the government does not respond to any circumstances.

If you want to exchange Perfect Money for a good exchange rate, press the button below!

Popular Perfect Money exchange directions:

- Exchange Perfect Money to USDT

- Exchange Bitcoin to Perfect Money

- Exchange USDT to Perfect Money

- Exchange Perfect Money to Bitcoin

Special Offer for Perfect Money Transactions!

For Perfect Money exchanges over $5,000 made through your personal account, you can receive a 0.1% refund on the transaction amount. To claim your refund, simply contact our support team.

We've updated our domain extension from .eu to .is!

3 comments

3 comments

Our new domain is now: https://www.xmlgold.is/

Please update your bookmarks and share the news so no one gets confused. We're still the same trusted XMLGold, just with a new web address!

Payeer Wallet Review: Sign Up, Log In, Verification, Fees, Security

Payeer is one of the most used currencies on the XMLGold cryptocurrency and e-currency exchange platform. Let's find out what the Payeer e-wallet is and how to use it properly. In this review, you will learn how to register in the Payeer payment system. Topics such as Payeer security, fees, deposit, and withdrawal options will be discussed. At the end of the article, we will summarize the pros and cons of the Payeer wallet. We hope this review will help you better understand the Payeer payment system.

As the number of people who use digital finance grows, therefore, demand market is also increasing. As a result, the number of digital asset management alternatives has grown. Digital asset management frequently provides users with digital or electronic wallets in which they deposit or withdraw funds.

Some of these systems have improved and expanded their features, and they now accept both fiat and crypto-currency payments. It has proven quite beneficial for the large number of consumers they occasionally attract.

Payeer is one such platform. Customers of Payeer can use this platform's numerous services and functions. Payeer is a crypto-currency exchange and a digital wallet for fiat and crypto-assets.

Payeer has a large number of features that have constantly resulted in excellent feedback for the platform. These include crypto-currency trading across many block-chains, asset storage, and rapid payment methods such as the Payeer payment system to fiat currencies.

The platform has also included a long list of new support options, such as withdrawals to MasterCard, Maestro, and other credit cards. Individuals who are considering using it as their primary electronic wallet will like the variety of alternatives for making payments or adding cash to the wallet.

Payeer SignUp Process

To sign up with Payeer, you will need:

1. Go to the payment service provider's official website.

2. Select "Create Account" from the drop-down menu (the button is located in the central part of the interface).

3. Type your E-mail address in the box provided.

4. As a code, type captcha.

5. Select "Create Account" from the drop-down menu.

6. Go through your emails.

7. Fill in the form field with the resultant number combination.

Everything is straightforward, as you can see. Only an email address is required by Payeer. In less than a minute, the user becomes the owner of a personal account with a payment system. We will go over the Payeer wallet registration process in greater detail below.

After arriving at the official Payeer website, the user should click the "Create an account" button in the middle of the main page. The users are redirected to a page where they must enter their email address and captcha code.

Click "Create an account" once more, but first familiarise yourself with the payment system's requirements for service supply. By default, selecting the "Create an account" button indicates that the user accepts the rules' terms. While you click the button, a box will pop up asking you to input a verification code that was previously given to the email address you provided, when filling out the previous form.

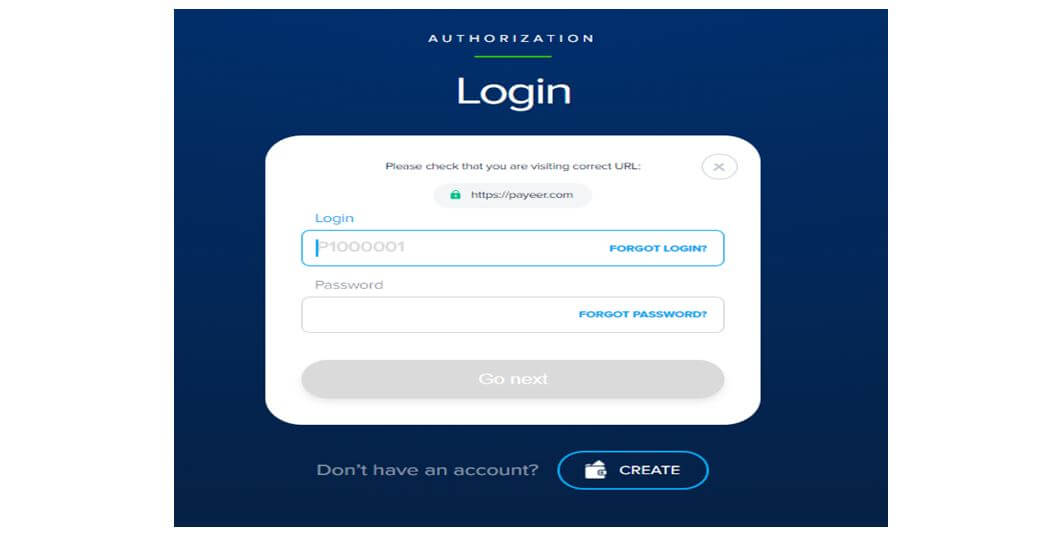

Payeer Login Process

A Payeer client must do the following to log into their account:

1. Go to the payment service provider's official website.

2. In the center of the interface, click "Login."

3. Fill in the information that the system requires.

4. Press "Login" once again.

The user should have no difficulty logging into Payeer's system. A username and password generated upon registration are only needed by the system. This combination of numbers and letters will be the key to the Payeer account if the user has not updated them yet.

Let's take a deeper look at the procedure for accessing the payment system.

After visiting the main Payeer page, select the "Login" button next to the "Create an account" button at the first step. The system will prompt you to enter your username, password, and security code, or captcha, in the next window.

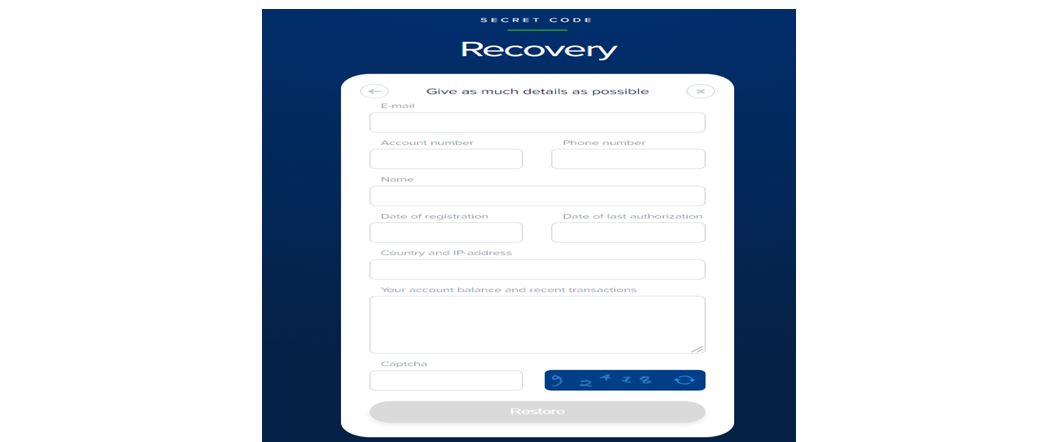

If you forget your password for any reason, it does not mean you will never be able to access your funds again.

Normally, such situations are taken into consideration by the service. In the form, next to the field requiring a password, there is a button labeled "Forgot your password?". This tool will assist the user in regaining access to their account and money directly.

After clicking the button, you will be sent to the restoration page, where we'll enter the login, secret word, and captcha code. Remember the secret word, along with the logins and password, was produced during the account registration process.

After you have successfully logged into Payer, it is a good idea to familiarise yourself with all of the system's features. Payeer offers an extremely easy UI, which makes engaging with the service more pleasant.

On the right side of the Payeer personal account page, you'll find the following sections:

- - "Balance" refers to the number of funds held in the payment system account.

- - “Transfer” is needed for settlements between the parties.

- - "Exchange" for converting cryptocurrencies for the Payer's fiat currency

- - History" is used to see the history of completed transactions and export them to CSV format (a delimited text file created to simplify work with large amounts of information).

- - The "API" is helpful when integrating with internet services.

Let's have a look at the top panel now. As a result, the total quantity of funds on the user's accounts in US dollars is displayed in the right corner of the screen.

On the right are located:

- - Notifications and news tab. It contains all of the information about your account as well as payment system news.

- - The account number includes information about the account's current status. You may add other security to your account by verifying your IP address and turning on SMS alerts.

- - The tab for selecting the interface language.

- - It's worth noting that the "Personal Account" only supports Russian and English.

- - Theme selection tab which includes dark or light, who likes which one.

- - A tab for contacting support.

- - Exit tab.

- - Settings tab. It allows you to reset your password, log in, track referrals, and view information about the cards used to make earlier payments.

Also, double-check personal information. Go to "Profile" in the section, where a form will appear that should be filled to pass verification.

We choose the account type and input the entire name, date of birth, country, and address. We verify all of these details by uploading an international passport or national identity card, and any other document that verifies the address, to the system. A utility bill or a bank statement will work.

After you have finished uploading your papers, click "Send for verification" and wait for confirmation. Please keep in mind that document verification might take up to 7 business days. The procedure may need to be repeated at times.

Payeer Fees

Payeer charges reasonable prices for the numerous services and features it offers to its customers. Each cryptocurrency has a separate trading cost. The deposit cost might be as high as 3.99 percent in some cases, depending on the payment method in use.

Other deposit and withdrawal transactions have a cost, and the company has listed numerous prices linked with their respective money.

Even though depositing Bitcoin into the wallet is free there is a minimum amount that is exchanged, which serves the same purpose as a minimum fee. Depositing fiat currency makes payments on the site.

Because of this direct digital deposits to the wallet are free to the platform, but fiat currencies are not. There are no fees associated with withdrawing crypto assets.

Although the charge appears to be larger than that of many local platforms, Payeer has maintained the fee reasonable by providing a more comprehensive package that minimizes the need to pay small amounts to various stages. As a result, consumers stop paying a single one for a small fee.

The fees for verified and unverified users are the same. Some rates are below:

- - International money transfer is free;

- - Currency exchange costs 2% of the amount exchanged, regardless of currency type;

- - Replenishment is free;

- - Output ranges from 0% to 5%;

- - SMS notifications: $0.05 per notification;

- - Password recovery is typically free; $50 if the account password is automatically recovered;

- - Account transfers are free;

- - The system pays back 0.95 percent of the amount received (if HYIP uses the API).

Payeer Security System

Payeer is expected to place a high priority on security, because of its activities on many continents and a rapidly rising user base. The platform has implemented several security measures to keep user information, data, and privacy safe and secure.

The measures include 2FA, which requires second permission and confirmation from the mobile device before performing transactions or utilizing specific Payeer platform services once the mobile phone authenticates with the account.

Verification may take time, based on many aspects to assure a close-knit and safe clientele. It may be discouraging, but having only authenticated users can be a wise tactic.

Without completing the verification, transactions, withdrawals, and other activities are limited to a certain point beyond which users are unable to advance.

Payeer is recognized as one of the most secure and trustworthy wallets currently accessible in much of South Asia, and it supports more than one cryptocurrency.

Users are alerted through an E-mail every time their account is logged into, another step toward a secure platform. It can assist them in keeping track of any activity that occurs within their account and catching a criminal in the act.

Payeer Deposit Options

The payment system wallet can be deposited in the "Balance" area, which offers information about the currencies supported by the service and their current status. There are a few options:

• Banks and cash (VISA, MasterCard, Maestro, and cash);

• Cryptocurrency (ETH, BTC, Advcash, Tether, LTC).

Bitcoin Deposit into Payeer's USD Account

Consider the procedure of using a cryptocurrency transfer to replenish a US dollar account.

Click the "Deposit" button in the "Balance" section of the USD account.

Select the deposit system and the required deposit amount in a new window.

Click "Deposit" once again. We consider the fact that this operation involves a commission from the system.

We then double-check the information and validate the operation.

If everything seems good, click "Deposit," but if you need to make changes, click the "Return" button on the form's right side.

The system will return the user to a page with the transfer address and the amount, which he has just 15 minutes to deposit after confirming the transaction.

Please keep in mind that the deposit amount should not differ from the amount offered by the provider, as this might cause issues with the account's receiving procedure.

We will wait for the amount on the USD balance to be updated now that the transfer is complete.

The system may prompt the user to validate his details depending on the deposit method selected.

So, if he wants to deposit money into an account using a bank card, he won't be able to do so until he uploads a photo of his passport and the bank card from which the transfer is made to a particular form after filling out all of the questions.

Payeer Withdrawal Options

Payeer withdrawals are done under the "Balance" area, which provides information about the currencies supported by the service and their present platform. Payeer money can be withdrawn in a variety of ways:

1. Banks and cash (VISA, MasterCard, Maestro, Cash);

2. Cryptocurrency (ETH, BTC, Advcash, Tether, LTC).

Withdrawing Bitcoins From A Payeer Account

Let's take a look at how to get money out of a Bitcoin account.

Click the "Withdraw" button in the "Balance" section of your BTC account.

The user will then be taken to a screen that requests the amount and the BTC address for the transfer. Withdrawing Bitcoin can only be done to another cryptocurrency network address.

The minimum and maximum withdrawal amounts are 0.001 BTC and 30 BTC, respectively.

We check for inaccuracies and confirm the withdrawal of funds when we finish the application.

In case of withdrawal limitations from other system accounts, the lowest withdrawal amount directly from Payeer is $ 0.02, and the maximum is $ 2,000, provided the user sends from an unverified account.

Where To Use The Payeer Payment System?

Compared to many of its competitors, the financial platform provides much more options. The usefulness of the payment functionality is determined by how the account is used.

After all, the demands of the individual paying for items on the Internet are very important to the business that utilizes the Payeer wallet to handle online payments.

Below is a list of useful features:

• No or cheap commissions;

• Sending payments to any location on the planet;

• A diverse variety of money deposit and withdrawal options;

• HYIP-to-HYIP transactions are instantaneous and flexible;

• Mass payments make it simple to transmit money and conduct transactions;

• Exchange service; international SWIFT transfers;

• Deposit funds through SWIFT and credit card deposits;

• Automatic bank transfers (bank cards);

• Easy signup (just an E-mail address is required);

• Extensive security (IP security, SMS security);

• Virtual playing cards (as a replacement for real cards) Accounts with several currencies;

• Funds are sent instantly;

• There is an affiliate program;

• The account is not locked;

• There is an iOS app.

How to Exchange Payeer?

XMLGold is one of the best options for exchanging Payeer. At XMLGold.eu (online digital currency exchanger) you can secure and cheaply buy, sell, or exchange Payeer EUR and USD in many other e-currencies and cryptocurrencies, for example, Bitcoin, Ethereum, Dogecoin, Litecoin, Dash, Dogecoin, Monero Tether, USD Coin, TrueUSD, Perfect Money, Perfect Money Vouchers EUR/USD, AdvCash, Bank Transfer, Sepa Transfer and many others.

How does it work?

Simply select the currency you want to buy on the right side and the currency you want to sell on the left side. Fill in the necessary amount for you and press “continue”, then fill in all the necessary information requested by the system. It will be fast and simple.

Note: If you want to buy or sell larger amounts, then choose option – “Extend Reserve”.

Tutorial on how to buy Payeer with Tether USDT:

Payeer vs Perfect Money

Payeer is a multi-currency payment method that involves sending and receiving fiat money along with cryptocurrencies. There are pros and cons to utilizing Payeer, but the best feature is that you may receive cryptocurrency and withdraw in fiat cash.

In addition to being a payment entryway for sending and receiving money, Perfect Money allows you to fund your account with Bitcoin and earn interest. You may withdraw your funds by many methods, including using Western Union.

Pros and Cons of Payeer

Pros:

• VFSC has authorized and regulated the company.

• Maintenance of your account is completely free.

• The low transaction, payment, and deposit/withdrawal commissions.

• Excellent site for purchasing and managing cryptocurrency.

• Merchants will find the payment mechanism to be quite convenient.

• It is available in over 127 countries.

• On Android and iOS, the app has a good reputation.

Cons:

• Only tickets are essential for technical support (no chat or phone).

• Other cryptocurrencies can be added to the platform.

Conclusion

There are so many payment processors available nowadays that it is difficult for dealers and customers to pick the one, which is the best. It is difficult for businesses and consumers to choose the best payment processor when there are so many.

Payeer Wallet is one of the greatest online e-currency e-wallets available. It provides both freedom and security. If you are looking for a new payment processor, you should try Payeer Wallet and log in to your account to learn more about its features.

Payeer Wallet can be helpful for you, particularly if you own an online store. It is a fantastic way for customers to purchase things without dealing with any hassles or restrictions. Take a closer look at this payment system if you are tired of the platform used for online settlements.

If you want to buy Payeer with Tether USDT (TRC20) press the button below.

Popular Payeer exchange directions: